- Fiscal deficit projected at N2trn in 2018

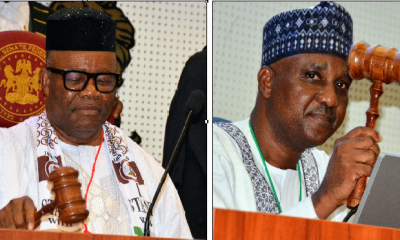

Presenting a record breaking N8.6 trillion to a joint sitting of the National Assembly on Tuesday, President Buhari in his address said that the nation’s budget shortfall will narrow next year as revenue from non-oil sources increases.

The 2018 budget of N8.6 trillion is 16 percent bigger than this year’s and is based on projected oil output, including condensates, of 2.3 million barrels a day at $45 per barrel and using an exchange rate of 305 naira per dollar, Buhari said.

He asked the lawmakers to approve the 2018 budget with a deficit of 2 trillion naira ($5.6 billion), compared to this year’s estimated fiscal gap of 2.356 trillion naira. Non-oil revenue is projected to triple to 4.2 trillion naira and will include funds raised from “restructuring of government’s equity in joint ventures,” he said in his budget speech in the capital, Abuja, without providing more details.

“The late passage of the 2017 budget has significantly constrained budget implementation,” Buhari said. He urged the National Assembly to approve the spending plans by Jan. 1 “in our efforts to return to a more predictable budget cycle that runs from January to December.”

Meanwhile, while commenting on the projections, John Asbourne, an economist at Capital Economics Ltd said the budget deficit would probably be higher than forecasted because non-oil revenue may not be as high as projected.

“We expect a budget deficit of 2.5 percent of gross domestic product compared to the forecast 1.77 percent,” he said.

ALSLO SEE: Buhari presents N8.612tn 2018 budget proposal to NASS

The deficit, National Daily gathered, will be funded by 1.7 trillion naira of borrowing, half of which will be external, and the privatization of non-oil assets to the value of 306 billion naira, Buhari said. A Budget Ministry document showed in February the government plans to generate money through asset sales in the next five years.

The government plans to reduce debt-servicing costs by almost doubling the portion of cheaper foreign borrowing to 40 percent of total liabilities. This strategy will free up more funds for development and started with an announcement in August that the government will issue dollar bonds to replace $3 billion of maturing domestic treasury bills.

“If the government will borrow externally as it has indicated, the budget has to be passed early so it can meet up with the funding gap,” Michael Famoroti, an economist at Lagos-based Vetiva Capital Management, said by phone. “There is the challenge of getting approval from the legislature and it’s something it can’t overlook.”

The government forecast economic growth of 3.5 percent in 2018, according to Buhari’s presentation. Inflation, seen at 12.4 percent for next year, may allow room for the CBN to ease monetary policy. It left the benchmark interest rate at a record high of 14 percent since July 2016.

Football2 days ago

Football2 days ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Education1 week ago

Education1 week ago

Crime1 week ago

Crime1 week ago

Covid-191 week ago

Covid-191 week ago

Latest6 days ago

Latest6 days ago

Aviation4 days ago

Aviation4 days ago