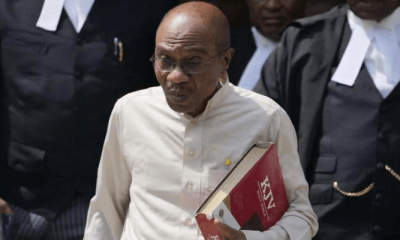

The Governor of Central Bank of Nigeria (CBN), Godwin Emefiele, has given reasons why the bank cannot cut the interest rate which is currently at 14 per cent at its recent Monetary Policy

Emefiele stated that “Conscious of the prevailing market sentiments in favour of a rate cut, the Committee reasoned that most of its decisions in 2016 were informed by the need to address the delicate balance between price stability and growth.”

Emefiele emphasized that noting that the pressures on consumer prices were yet to abate and even as the economy continued to be in recession despite the intervention support by the Central Bank, the Committee stressed that it was not oblivious of the full ramifications of the economic challenges facing the country.

“The MPC was concerned that the current situation was not amenable to simplistic analyses and quick fixes such as have found expression and increased attention at different fora and the media.

The domestic economic challenges which include a chronically import dependent consumption culture, lack of competitiveness of many sectors of the economy and yawning infrastructural gap, have combined with an unfavorable external environment to complicate the macroeconomic policy environment,” he had declared.

He maintained that “The Monetary Authority had on many occasions, and to the extent feasible, taken extra-ordinary steps to support other policies as well as compensate for aspects of structural gaps in the economy even at the expense of its core mandate.”

According to the governor, The policy of setting aside 60 perc ent of total foreign exchange available to banks for the manufacturing sector would continue, even as he added that operators in the nation’s electricity sector qualified for the 60 percent forex priority for manufacturers and should take advantage of it.

“The 60 per cent that has been set aside of all fx that is available to all the banks to manufacturers, we did that for a purpose because we felt that there is need to support manufacturing sector.

There is need to ensure that foreign exchange is made available to those that will provide jobs and get the manufacturing and industrial outputs to look positive.

And I am happy that the recent data released by the Nigerian Bureau of statistics has started to show that the PMI is looking upward. “The 60 percent that is set aside for the manufacturers, I dare say that those in the power sector also qualify for that because they are importing plants and equipment or components for their transformers and generators for their machines.

I don’t mean generators that people will put in their houses and generate electricity for themselves. We will appeal to the banks to look in their directions increasingly.”

He disclosed that the nation’s foreign reserve is now $28.9 billion. Though he noted the reserve base is exciting but added that there is the need to float the Naira.

“It is important to note that we have to manage the reserve, that means from time to time we will intervene in the market to make sure the exchange rate does not go beyond our expectations and those interventions will be to moderate the rates as necessary.

“The fact that we have begun to see some accretions to the reserves does not mean we have to be reckless. We will continue the policy of ensuring that foreign exchange is made available to those who are importing raw materials, plants and equipment, those supporting agricultural sector and not those who want to engage in what I can regard as less important sectors.”

Emefiele, also said that the Cash Reserve and the Liquidity Ratios were also retained at 22.5 per cent and 30 per cent, respectively.

Emefiele, said that the apex bank would continue to work towards closing the gap between the interbank and parallel market rates.

We will continue to increase our interventions to make forex more available to the priority sectors and we believe that as we continue to do that the urge for people to continue to go to what I would regard as the illegal market would continue to reduce,” he said.

Football5 days ago

Football5 days ago

Aviation7 days ago

Aviation7 days ago

Aviation6 days ago

Aviation6 days ago

Featured3 days ago

Featured3 days ago

Comments and Issues5 days ago

Comments and Issues5 days ago

Education4 days ago

Education4 days ago

Business4 days ago

Business4 days ago

Featured1 week ago

Featured1 week ago